February 20, 2024

February 20, 2024

Complaints Policy

1. Management Responsibilities

The Senior Management Team are responsible for the approval of the Complaints Policy and for monitoring compliance with it.

2. Compliance Team Responsibilities

The Compliance team is responsible for ensuring complaints are resolved satisfactorily for MNG. It is fully responsible for analysing complaints and the complaints handling data to identify and address any risks or issues.

1. Definition of a complaint

The FCA defines a complaint as any oral or written expression of dissatisfaction from or on behalf of a client, whether justified or not, which includes an actual or potential financial loss, material distress or material inconvenience.

The Financial Conduct Authority complaints rules apply to complaints that are:

a. Made by, or on behalf of, an eligible complainant.

b. Relating to regulated activity only.

c. Involving an allegation that the complainant has suffered, or may suffer, financial loss, material distress or material inconvenience.

2. Definition of eligible complainant

An eligible complainant is a complainant that is:

a. A consumer (a person acting outside their trade, business or profession).

b. A micro enterprise (enterprise which employs fewer than 10 people and has a turnover or balance sheets that does

not exceed EUR 2,000,000).

c. A charity with an annual income of less than £1,000,000.

d. A trustee of a trust which has a net asset value of less than £1,000,000.

If in doubt whether a complainant is an eligible complainant or not, MNG will treat them as an eligible complainant.

Only eligible complainants can refer their complaints on to the Financial Ombudsman Service.

It is MNG’s policy to treat all complainants the same; however, eligible complainants are legally defined and have additional rights in law that MNG must acknowledge and adhere to. MNG has elected to treat all complaints in the same way for simplicity. Occasionally MNG may not know if a complainant is ‘eligible’ in which case it will treat them as such and if it becomes necessary, the Financial Ombudsman Service will establish the status of the complainant, MNG. Clients and potential clients are able to submit complaints free of charge.

Complaints will be handled promptly, effectively and in an independent manner, obtaining additional information as necessary.

MNG will always communicate with clients and potential clients clearly in plain language that is easy to understand and will reply to the complaint without undue delay.

MNG will assess fairly, consistently and promptly:

a. The subject matter of the complaint

b. Whether the complaint should be upheld

c. What remedial action or redress may be appropriate

d. Whether another party may be solely or jointly responsible for the matter alleged in the complaint

MNG will promptly comply with any offer or remedial activity or redress accepted by the complainant.

MNG will consider a complaint closed when it has issued a final response.

MNG will provide information about the Financial Ombudsman Service to eligible complainants on its website and if applicable, in the general conditions of its contracts with eligible complainants in a clear, comprehensible and easily accessible way.

1. Time Scales

For all complaints, including those relating to payment services, MNG has 15 business days to issue a final response to the complainant and it requires that this practice is followed (as a maximum timescale) for all complaints unless there are exceptional circumstances, beyond the control of MNG, in which case the final response will be issued by the end of the 35th business day. Should the investigation into the complaint exceed the deadline, MNG will provide a status update to the complainant.

If MNG satisfactorily resolves the complaint by close of business on the fifteenth business day following the receipt of the complaint then MNG will issue a written “Summary Resolution Communication” to the complainant, advising that it considers the complaint as resolved and inform the complainant, for eligible complainants, about their options for referring the complaint back to MNG or for onward referral to the Financial Ombudsman Service if they are dissatisfied.

In addition to sending a complainant a “Summary Resolution Communication”, MNG may also use

other methods to communicate the information where:

a. It considers that doing so may better meet the complainant’s needs; or

b. The complainant and MNG have already been using another method to continue to communicate about the complaint.

On receipt of a complaint, MNG will send the customer a prompt written acknowledgment within 3 business days of receipt providing confirmation that it has received the complaint and is dealing with it or a summary resolution communication (if the complaint can be resolved within 3 business days).

MNG will ensure that the complainant is kept informed of the progress of the measures being taken for resolution of the complaint. MNG will write to complainants before the 35 day deadline if it has not reached a decision.

MNG will issue a final response to the complainant within 15 business days and inform the complainant, for eligible complainants, about their options for onward referral to the Financial Ombudsman Service.

Letter

Time Frames

The final response will clearly set out:

a. Whether MNG accepts or rejects the complaint

b. The reasons for rejection, where applicable

c. The intention to offer redress or remedial action, where applicable

d. Details of the redress to be offered and any compensation offered with a clear method of calculation.

Additionally, where the client is an eligible complainant, MNG will:

a. Explain that where the complainant disagrees with MNG’s decision they must refer the matter to the Financial Ombudsman Service within six months of the date of this letter or the right to use this service is lost, and

b. Enclose a copy of the Financial Ombudsman Service’s standard explanatory leaflet.

MNG will consider a complaint closed when it has issued its final response.

2. Complaints forwarding

MNG may promptly forward the complaint in writing to another party if they have reasonable grounds to believe that the other party may be solely or jointly responsible for the matter alleged in the complaint. If a complaint is forwarded, MNG will inform the complainant promptly in a final response of why the complaint has been forwarded to another party and provide the complainant with the other party’s contact details.

If MNG receives a forwarded complaint, the complaint will be treated as if MNG has received the complaint directly and the same time limits will apply from the date on which MNG has received the forwarded complaint.

3. Complaints time barring

If MNG receives a complaint which is outside the time limits for referral to the Financial Ombudsman Service, it may reject the complaint without considering the merits but will explain this to the complainant in its final response.

Unless MNG consents, the Financial Ombudsman Service will not consider a complaint if the complainant refers it to the Financial Ombudsman Service:

a. More than six months after the respondent sent the complainant its final response

b. More than six years after the event complained of

c. More than three years from the date on which the complainant became aware that he had cause for complaint

4. Financial Ombudsman Service

MNG will cooperate fully with the Financial Ombudsman Service in resolving any complaints made against it and agrees to be bound by any awards made by the Ombudsman. MNG undertakes to promptly pay the fees levied by the Financial Ombudsman Service.

5. Alternative Dispute Resolution Arbitrator

Given the nature of some of MNG’s customer based (corporate based merchants) some of them may not be eligible for the Financial Ombudsman Service. In that case, an alternative dispute resolution provider will be provided.

6. Analysis

MNG will conduct root cause analysis of any complaint received and record any appropriate actions taken. Complaints will be analysed for any recurring patterns and all lessons learnt will be incorporated into future training and development. The causes of complaints will be recorded in the Management Information and will be used with the prioritisation of dealing with the root causes.

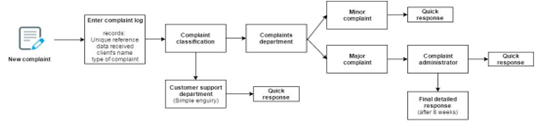

Complaints will be referred, either verbally or in writing, to the nominated complaints at the earliest opportunity.

MNG will then:

01

Make an initial assessment of the complaint, contacting the complainant for further information if required. This can be done via telephone, email or any other appropriate means of communication.

02

Enter the complaint onto the Complaints Log and create a Complaint Record.

03

If there is sufficient information and the complaint can be resolved within 15 business days, then proceed to step 9.

04

If the complaint cannot be resolved within 15 business days, send out an initial response letter to the complainant using the Initial Response Letter Template within 3 business days of receipt of the complaint, adding the details known about the complaint by the next working day and stating that the complaint has been received and is being dealt with.

05

Investigate the complaint impartially, obtaining additional information from MNG and/or the complainant as necessary.

06

Assess fairly, consistently, and promptly:

a. The subject matter of the complaint

b. Whether the complaint should be upheld

c. What remedial action or redress (or both) may be appropriate

d. If appropriate, whether it has reasonable grounds to be satisfied that another

party/respondent may be solely or jointly responsible for the matter alleged in the complaint.

07

If appropriate, forward the complaint to the relevant party/respondent and advise the complainant in writing the reason why the complaint has been forwarded to the other party and provide the other party’s contact details.

08

If the complaint is unresolved after 15 business days, send out a holding letter using the Holding Letter Template, advising an expected resolution date that is within 35 business days.

09

If the complaint is resolved, communicate MNG’s position on the complaint to the complainant and inform them about their options, including that they may be able to refer the complaint to an alternative dispute resolution entity (Financial Ombudsman Service for eligible complainants) or that the complainant may be able to take civil action, using the Final Response Letter Template.

10

In the final response letter, clearly set out whether MNG accepts or rejects the complaint, the reasons for rejecting any complaint or where MNG accepts the complaint, and intends to offer redress or remedial action, details of the redress to be offered, any compensation offered and a clear method of calculation.

a. Additionally, for complaints raised by eligible complainants, in the final response letter enclose a copy of the Financial Ombudsman Service’s standard explanatory leaflet, provide the website address of the Financial Ombudsman Service and inform the complainant that if they are still dissatisfied with MNG’s response, the complaint may now be referred to the Financial Ombudsman Service.

b. Additionally, for complaints raised by non-eligible complainants, in the final response letter enclose details of an independent, commercial dispute resolution service and inform the complainant that if they are still dissatisfied with MNG’s response, the complaint may now be referred to the dispute resolution service.

11

Comply promptly with any offer of remedial action or redress accepted by the complainant.

12

Conduct a root cause analysis in the case of any complaint and record with the appropriate action having been taken. Record any actions within the individual complaint record.

13

Liaise with MNG Risk and Compliance Manager if any changes need to be made to MNG’s procedures based on the analysis.

14

Update the Complaints Log and Complaints Record with the final decision including details of the amount of any redress offered.

MNG will keep a record of each complaint received and the measures taken for its resolution, including any redress offered, and retain that record for three years from the date the complaint was received.

Once a year, MNG will provide the FCA with a complete report concerning complaints from complainants. Complaints that have been forwarded in their entirety to another party will not be included in the report.

The master log will contain the relevant details to be reported to the FCA.

Any breaches of the Complaints Policy will be recorded on MNG’s breach log in conjunction with its Regulatory Breach policy.

Financial Ombudsman Service

Address: The Financial Ombudsman Service, Exchange Tower, London E14 9SR

Tel: 0800 023 4567 (free for most people ringing from a fixed line) or 0300 123 9123 (cheaper for those calling using a mobile) or 44 20 7964 0500 (if calling from abroad)

Email: [email protected]

Website: www.financial-ombudsman.org.uk

Manigo Services Ltd

Level 39, One Canada Square, London, E14 5AB

Email: [email protected] I Registration No: 09895618

©2023 Manigo Service Ltd. Proprietary.

All rights reserved